Investeringsagenda maakt werk van de transitieopgaven

Een coherente, regionale Investeringsagenda geeft richting aan de Metropool van Morgen. Met investeringen die elkaar aanvullen en ondersteunen in het aanpakken van de grote regionale opgaven. Amsterdam Economic Board is dan ook voorstander van het investeren in ‘transitieversnellers’. In juni verschijnt de eerste versie van de agenda.

Met transitieversnellers – een beperkt aantal, grote en actuele investeringen – bouwt de regio aan een nieuwe economie voor een slimme, groene en gezonde Metropool van Morgen.

De Investeringsagenda die onder aanvoering van de Metropoolregio Amsterdam en in coproductie met de Amsterdam Economic Board wordt opgesteld, zet de belangrijkste investeringen op een rij. Zo wordt het voor grote en kleine spelers in de Metropool Amsterdam mogelijk hierop samen te werken. Maar ook om hun andere plannen af te stemmen op de verwachte grote investeringen die in de regio gedaan worden. Meer investeringszekerheid versterkt de samenwerking in het innovatie-ecosysteem in de regio en vergroot de gezamenlijke impact.

Denk bijvoorbeeld aan een slim en geïntegreerd stroomnet met voldoende capaciteit: een belangrijke voorwaarde voor de verduurzaming van bedrijven, woonwijken en mobiliteit. Of het ontwikkelen van een datadeelinfrastructuur, zodat partijen slimme AI-oplossingen kunnen realiseren, bijvoorbeeld voor een betere zorg.

“De transitie-opgave is groot. Het energiesysteem verandert, er ligt een grote bouwopgave, de mobiliteit en logistiek worden emissievrij, tegelijkertijd bewegen we naar een circulaire economie. Voor alle betrokken organisaties is dit een enorme opgave die vaak verder gaat dan wat vanuit een partij mogelijk is. Hier ligt een rol voor de MRA Investeringsagenda: door te investeren in transitieversnellers die inspelen op de knelpunten waar de bedrijven in hun opgave tegenaan lopen, kunnen de gemeenten en provincies de goede voorwaarden scheppen. Hierdoor wordt de transitie realiseerbaar voor bedrijven in de MRA.”

Pallas Agterberg – Directeur strategie Alliander

Het begrip transitieversneller is nieuw en er is nog geen gedeeld beeld van wat dat is. In dit artikel doen we een voorzet: is investeren in transitieversnellers gewenst? Zijn we het eens over wat een transitieversneller dan is? Welke transitieversnellers selecteren we? En hoe kunnen we het versnellende effect dan maximaliseren?

Zet in op een andere manier van organiseren én investeren rondom complexe transitie-opgaven

Is investeren in transitieversnellers gewenst? Wat ons betreft wel. Transities zijn complex en vereisen een andere manier van organiseren, maar ook van investeren.

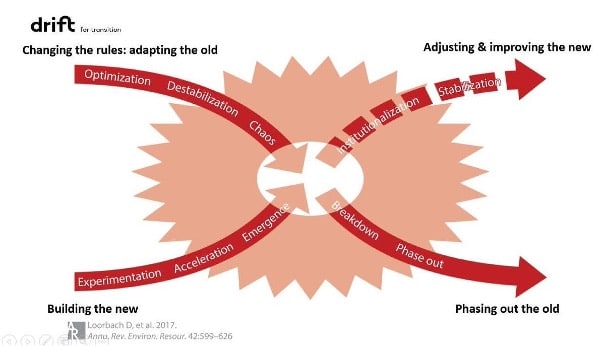

Een transitie bestaat uit een groot aantal zaken die gelijktijdig gebeuren, waarbij veel partijen en personen betrokken zijn en waarbij soms onverwachte wendingen, vertragingen of versnellingen ontstaan. Het onderzoeksinstituut Drift ontwikkelde de X-curve om te laten zien dat zo’n verandering niet in een rechte lijn gaat. Een transitie bestaat enerzijds uit het afbouwen van oude, niet meer relevante structuren, producten, diensten en gedrag en anderzijds uit het opbouwen van nieuwe, gewenste zaken.

Lees verder onder de afbeelding

Wie te veel kiest voor quick wins om bestaande zaken te optimaliseren, mist het pad naar structurele oplossingen. Wie wel experimenteert maar niet opschaalt in de nieuwe paden, loopt op een gegeven moment vast. Uiteindelijk moeten ook de ongewenste economische structuren worden afgebroken of worden uit gefaseerd. En de maatschappelijke gevolgen worden opgevangen. Dan ontstaat er ruimte voor vernieuwing. Denk aan het sluiten van de Hemwegcentrale die de ruimte biedt voor nieuwe duurzame concepten.

Transitie-opgaven vragen om samenwerking. Het gaat om systemische veranderingen die bedrijfsleven, overheden en kennisinstellingen niet alleen kunnen realiseren. Daarbij is een integrale aanpak nodig die sector- en domeindoorsnijdend is en slimme verbindingen legt tussen bijvoorbeeld economie, duurzaamheid, ruimtelijke ordening, onderwijs & arbeidsmarkt en digitalisering.

Vanuit de Board geven we invulling aan deze vernieuwende manier van samenwerking via netwerksturing. Als 'spin in het web' orkestreren we transitieprocessen in de Metropool Amsterdam en bouwen we coalities van partijen uit ons netwerk die samen willen werken aan de transitie-opgaven van de regio.

Drie redenen om te investeren in Transitieversnellers

Ook op het gebied van financiering helpt het als er meer focus en richting komt. Verschillende financiers kunnen dan beter samenwerken, zodat echte transitie-impact tot stand komt. De MRA-Investeringsagenda richt zich op investeringen die transities versnellen, en dat is wat ons betreft een goede keuze. We kiezen niet alleen richting, maar we spelen ook in op urgentie en we vergroten kansen door deze slimme samenwerking.

Richting: door slim te investeren kunnen we nu ook proberen de transitie in de gewenste richting te duwen en de toekomstige rol en propositie van de Metropool Amsterdam vorm te geven. Met de Regionale Investeringsagenda pleiten we voor die investeringen die transities op een duurzame en verantwoorde manier versnellen. Door bewust te kiezen, bijvoorbeeld aan de hand van de Impactlenzen, neemt als belangrijk bijeffect ook het investeringsvolume in minder verantwoorde of duurzame zaken af. Geld dat naar walstroomaansluitingen in de haven gaat, komt bijvoorbeeld niet bij dieseltankpunten terecht.

Urgentie: het probleem dat we willen oplossen, bestaat vaak nu al, maar als we niets doen of doorgaan op de oude weg, wordt het probleem alleen maar groter. Als we tijdig in beweging komen, is de kans kleiner dat we later radicalere acties moeten nemen. Bijvoorbeeld: blijft fast fashion de norm, dan vergroot dat het afvalprobleem in de toekomst. Of zoals UvA-promovendus Stan Olijslagers stelt: "Nu investeren in CO2-reductie betaalt zich uit in de toekomst."

Kansen: Als we transities willen versnellen, moeten we ook de kansen van nu grijpen. Actueel zijn de financieringskansen van het Nationaal Groeifonds en de European Green Deal. Maar denk ook aan de forse investeringen die sowieso gedaan worden in de Metropool Amsterdam in het komende decennium, zoals de investeringen in nieuwe woningen. We kunnen die nu gebruiken om ook andere doelen te bereiken, zoals het versnellen van de circulaire industrie, en zo tegelijkertijd meer werk creëren.

Welke transitieversnellers hebben we voor ogen?

Op het eerste gezicht zijn er een aantal zaken die echt voorwaardelijk zijn voor transities. Onze voorzet: investeer in infrastructuur, digitalisering en mensen.

Een toegankelijke, slimme, goed verbonden infrastructuur voor energie, vervoer, circulaire stromen en data, waarvan de capaciteit optimaal gebruikt kan worden is een belangrijke voorwaarde. Denk aan logistieke hubs, circulaire verwerkingscapaciteit, en het mogelijk maken om data te delen. Niet alleen investeren in kabels en leidingen, maar ook in technologische innovatie, andere regelgeving, verdienmodellen, protocollen en governance.

En investeer in digitale mogelijkheden. De Europese Commissie heet het niet voor niets over de twin transition: Verduurzaming en Digitalisering gaan hand in hand. Dus laten we vooral ook kijken hoe de inzet van AI en databased werken de maatschappelijke opgaven kan versnellen.

Investeringsplannen zijn niets waard als er geen mensen zijn om ze te realiseren. En gebrek aan goed opgeleide mensen met de juiste skills is nu vaak een belemmerende factor. Daarom hoort bij elke investering een gedegen opleidings- en uitvoeringsplan. En moeten we ook in de breedte investeren in omscholing, doorstroming en het selecteren op basis van skills in plaats van alleen op basis van diploma’s en ervaring.

Het versnellend effect maximaliseren

We zijn op zoek naar transitieversnellers: investeringen die nu mogelijk zijn en richting geven, maar ook een versnellend effect kunnen hebben. Dat effect is het grootst op de lange termijn, als er samenhang in investeringen ontstaat. Als bedrijven en andere investerende partijen elkaar versterken als ecosysteem. De MRA-Investeringsagenda staat immers niet op zich. ROM InWest en Horizon, de ontwikkelingsmaatschappij NHN, GO-NH en banken, fondsen en talloze private investeerders zorgen ook voor investeringsgelden. We pleiten ervoor dat ook zij investeringen beter op elkaar afstemmen.

We voorzien verschillende soorten versnellende effecten, die ook allemaal wat anders vragen náást de investeringen:

Een faciliterend effect maakt zaken mogelijk die dat daarvoor niet waren of niet op die schaal of plek. Een nieuwe woonwijk kan bijvoorbeeld niet functioneren zonder een goede ontsluiting voor voetgangers, fietsen, auto’s en OV.

Een spinoffeffect kan je ook een positief neveneffect of bijproduct noemen. Bijvoorbeeld een onderneming die ontstaat vanuit wetenschappelijk onderzoek.

Een vliegwieleffect kan ontstaan door meerdere, elkaar versterkende duwtjes in dezelfde richting te geven, waardoor een versnelling ontstaat. Voor meer Tech talent van eigen bodem investeren we bijvoorbeeld in laagdrempelige opleidingen, financiering van bijkomende kosten tijdens zo’n opleiding, en in banenmarkten waarin men echt aan het werk komt.

Het hefboomeffect of leverage is een manier om met een kleine actie een grotere gewenste beweging te creëren, door de invloed die die actie heeft op haar omgeving. Voorbeeld: investeren in fietspaden zal eerder investeringen in fietsen uitlokken dan investeren in snelwegen.

Met het multipliereffect bedoelen we hier dat de ene investering de andere kan uitlokken. Doet partij A een investering, dan kunnen veel andere partijen ook investeren. Als voorbeeld: investeren in meer capaciteit op het stroomnet, zorgt ervoor dat allerlei bedrijven kunnen investeren in elektrische productieprocessen. Maar ook: zegt partij B toe een deel van een investering op zich te nemen, dan wordt het voor andere partijen haalbaarder om mee te investeren.

Het opschalingseffect, waarbij het effect van de investeringen groter wordt door:

- Uitrollen – het vergroten van het volume door nieuwe markten of gebieden aan te boren. Bijvoorbeeld het plaatsen van laadpalen op nieuwe plekken.

- Kopiëren – het (vaak door andere partijen) toepassen van een goede oplossing in een nieuwe setting. Bijvoorbeeld een project uit Haarlem bestuderen en daarmee een project in Almere vormgeven.

- Uitbreiden – groeien door meer content, diensten, producten of partners toe te voegen. Bijvoorbeeld in een Green Deal nieuwe partners of nieuwe topics toevoegen.

Versterk ook de innovatieve ecosystemen in de Metropool Amsterdam

Alléén investeren is niet genoeg. Een voorwaarde om de versnellende effecten van investeren in transitieversnellers ook echt te laten optreden is een sterk innovatie- en ondernemerschapsklimaat. Door te investeren in een vruchtbare bodem voor samenwerking, voor het laten groeien van startups, met onverwachte ontmoetingen groeit de kans dat er interessante projecten ontstaan die niet op zichzelf staan. In de Metropool Amsterdam zijn er tal van samenwerkingsverbanden die hierin een rol vervullen, waaronder de Amsterdam Economic Board. Als speler zonder direct eigen belang kan de Board urgente thema’s agenderen, ecosystemen versterken en samenwerking gericht aanjagen. Vanuit deze rol helpen we de juiste keuzes te maken voor transitieversnellers die goed zijn ingebed in het MRA innovatie-ecosysteem.

17 maart 2022

Meer weten over

Neem contact op

Blijf jij ook op de hoogte?

8x per jaar nieuws en events uit de regio: schrijf je in voor de Board Update nieuwsbrief

Deel dit artikel

Wil je op de hoogte blijven?

Volg ons dagelijks op LinkedIn en schrijf je in voor de Board Update nieuwsbrief.

Lees ook deze berichten

- Met de selectie van vier kanshebbers is de regionale voorronde van de ...

- Met meer dan 80 ondernemers, 40 investeerders en diverse dienstverleners bood LSH Capital Match ...

- In tijden van geopolitieke spanningen, technologische revoluties en politieke onzekerheden is het ...